[Spoiler Alert]: Here Are The REAL Reasons You Should Bundle Your Home and Auto Insurance

[Spoiler Alert]: Here Are The REAL Reasons You Should Bundle Your Home and Auto Insurance

I think by now if you have paid attention to any insurance marketing you probably have heard the term “bundling” more often then you would like to hear the term. Between Flo’s bundle price gun and other large name insurance carriers claiming to “bundle your way to savings it is time to cut through the fluff and clarify exactly why should combine your homeowners and auto car insurance policies.

By the way Bundling or Combining in the insurance space means to bring together two or more insurance policies with the same company to achieve multiple purposes of saving money convenience and oh so much more.

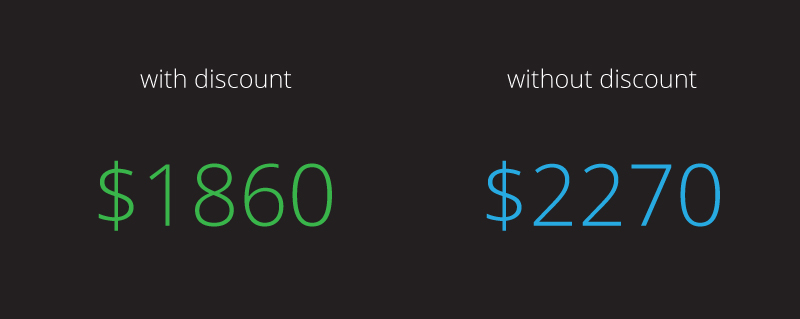

What we did here at Dick Watts Insurance is an audit of all our insurance policy holders and we found some interesting data. Check this out! After our audit we found that our average 2 car household premium with homeowners insurance combined is approximately . $1860. The average multiple policy discount across all of our insurance companies is 18%, so $1860 is the average rate after the 18% muti-policy discount, which means you save approximately $410 annual on insurance. If you are a millennial or single mother or single father reading this, serious savings and cash could be put toward other expenses.

If you are a baby boomer reading this those are valuable savings and assets the could be invested for retirement savings.

Insurance Bundling Discounts home and car insurance

As with most things that have to do with home and car insurance I tend to get more excited then the normal consumer, since it is my job!

So let’s chat about some other great reasons why you would want to combine your insurance policies in addition to the discount you get on your rates.

The Combined Insurance Discount

Homeowners Insurance storm damage

With some home and auto insurance companies and car insurance companies , there is a benefit offered called the combined deductible. This is where you have the home and car insurance companies combined with the same insurance company or insurance carrier . In the event of a loss that affects both your home and auto insurance policies the company offers a shared deductible. For example, if you are backing out of your garage and hit the garage with your car. Now you have one occurrence for each policy the home and auto insurance policies and could incur two separate deductibles for the home insurance claim and the car insurance claim. Some insurance companies offer the combined deductible so you end up only paying one deductible for the loss or claim.

This is simply not possible when you have your policies with two separate insurance companies and could save you hundreds of dollars which is especially important in the event of an at fault claim. It is also saving you money simply on your car and home combined insurance rates and premiums.

The Ultimate Time Saver

Auto Accident Insurance

The blessing to having and independent insurance agent like myself , is that we are a one stop shop for all of your insurance needs, no matter what companies carry your auto insurance policies. An even better bonus is that we can work together to place all of your insurance with the same carrier to make the best use of your time as a consumer . The last thing anyone wants to do is to all call around to a bunch of insurance companies for multiple insurance quotes. In the most recent insurance example one of the major insurance companies we represent came out with a new innovative mobile app to better serve our customers . The insurance company mobile app allows you to input your policy numbers with the insurance carrier and it will populate all of your policy information so you can obtain car insurance proof of insurance cards, make payments and report accidents and report claims. Safeco Insurance for the win

will also show me as your independent insurance agent in the mobile app to make sure you are best served at all hours of the day!

I am going to be bold here and say the following, have you ever heard the saying “too many cooks in the kitchen can spoil the broth!” Well the same applies to insurance. Too many insurance agents in your household can lead to serious insurance coverage gaps and possible claims problems. Gaps in your insurance coverage can be a real issue, that is why it is best to work with one Independent Insurance agent in Kentucky. We can combine your home and car insurance policies and offer personal umbrella insurance to offer the best coverage. Only an insurance agent who is paying attention will catch this!

Boat Insurance quote!

Combining your home and auto insurance is just the start of the excitement! By combining your boat insurance, ATV insurance, Motorcycle Insurance and RV Insurance and Motorhome Insurance you are allowing yourself to save even more money! When you bring all of your household possessions under one insurance roof, like our independent insurance agency, it is giving you the best option for savings and convenience.

Why do Insurance Companies Love when your Combine Home and Car Insurance with One Insurance Company?

Combine Home and Car Insurance for Savings and discounts

Time for the insurance truth! Insurance companies and Insurance agencies love when you combine all of your insurance with the same insurance company. In 2012 JD Power and Asssociates completed an insurance study on insurance consumers and found Customer Services satisfaction rankings skyrocketing due to policy bundling. The study showed a clear message in that customers felt happier, safer and more protected when they combined insurance policies with the same insurance agency.

Multi- Policy Discounts Home and Car Insurance Discounts!

Home Insurance and Car Insurance Discounts!

I have mentioned it a few times above and as mentioned in the introduction, you are equipped by the insurance marketing world to know that bundling your insurance policies will save you money. #Truth #Savings #Money Some Insurance companies offer as much as a 20% discount of the total insurance rate if you combine another line of insurance with your primary carrier. Using your independent insurance agent to navigate with you to find that you are getting the best insurance rate and all available discounts!

So your next steps to save money!

I will give you a guide on what you can do next ; Next Steps

- Check out where you are currently on your home and car and renters insurance. If they are with different insurance agencies or insurance companies then it would be best to look for an independent insurance agent where you could combine all of your insurance policies with the same insurance company.

- If you have an independent insurance agent that you like to work with, have them shop for a lower rate by combining your home and car insurance policies with the same company. If you don’t have an insurance agent call us today and we can conduct a free insurance review.

- Evaluate what is best for you and your family moving forward. If it is best to combine the home insurance and car insurance then your agent should be able to help you with this. If you found this article helpful, request a free insurance quote from our website: